70 travellers caught for evading taxes, duties in week-long operation at S'pore checkpoints

Gabrielle Andres

The Straits Times

Jan 22, 2026

Seventy people were caught for failing to declare and pay taxes for goods at Singapore's checkpoints during a week-long multi-agency enforcement operation, the authorities said on Jan 22.

The operation – conducted by the Singapore Police Force, Immigration and Checkpoints Authority (ICA) and Singapore Customs – was to detect and enforce against non-compliance with Singapore's cross-border cash reporting regime and other illegal cross-border activities, the agencies said in a joint statement.

More than 10,000 travellers and 260 vehicles were identified for checks, and over 14,000 pieces of luggage and hand-carry bags were scanned or searched at Singapore's land, air and sea checkpoints.

During the operation, $3,398 in duties and goods and services tax was found to have been evaded for items such as cigarettes and tobacco products, liquor exceeding duty-free concession and goods exceeding GST import relief.

A total of $21,990 in composition sums was imposed.

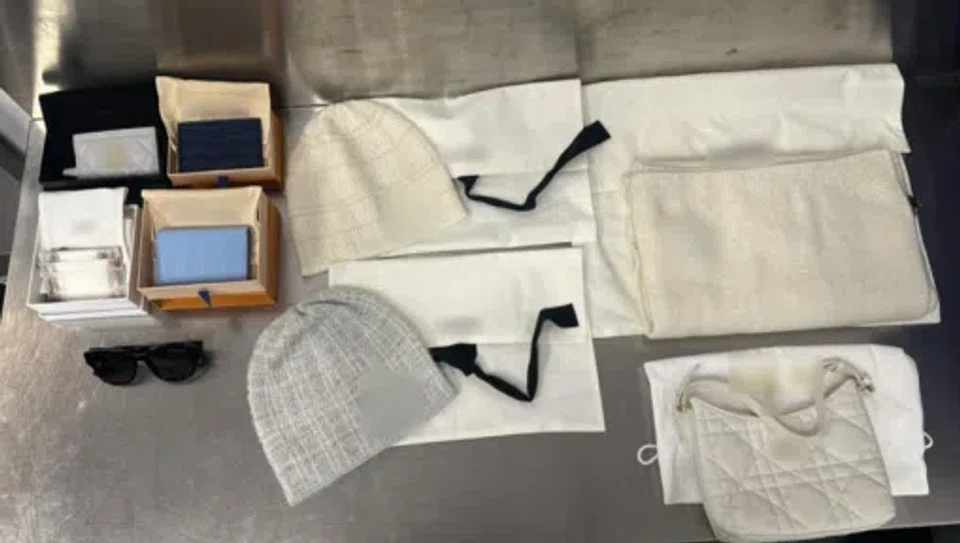

"The cases include a traveller carrying six sets of undeclared roller blinds, another with undeclared assorted luxury goods, and a third with undeclared smartwatches," the agencies said, adding that all offences were compounded.

ICA also detected two travellers moving cash exceeding the permitted limit of $20,000 into and out of Singapore without declaration, or having declared the amount inaccurately.

The first case involved a 46-year-old foreign woman who was found to have been carrying foreign currencies amounting to $24,965 into Singapore without declaration on Jan 13. She was issued a notice of warning.

In the second case, a 49-year-old foreign man was caught attempting to move cash cheques amounting to $91,789 out of Singapore without declaration on Jan 14. He was issued a composition sum of $9,000.

"Singapore takes a serious view against cash smuggling and any related money laundering activities, and will not hesitate to take stern enforcement actions against any individuals who commit these offences and persons who facilitate them," the agencies said.

The authorities reminded travellers that it is a statutory requirement to declare if they are moving cash or bearer negotiable instruments – such as cheques or money orders – amounting to more than $20,000 or its equivalent in foreign currency.

They added that travellers are responsible for accurate and complete declarations of dutiable and GST-payable items. Those who fraudulently evade Customs or excise duties may be fined up to 20 times the amount evaded, jailed for up to two years, or both.

Meanwhile, those who fail to report or accurately report the movement of cash or bearer negotiable instruments exceeding the permitted amount may be fined up to $50,000, jailed for up to three years, or both.

A confiscation order may also be issued for any part of the cash related to the offence.