At least $100k lost in a week by scam victims duped by SMS reminding them to redeem Singtel points

At least 14 cases of a phishing scam involving the impersonation of Singtel were reported to the police with total losses amounting to at least $100,000 since Sept 2, said a police advisory on Sept 7.

The scam victims would receive an SMS informing them of expiring Singtel points with a link to redeem gifts with their points.

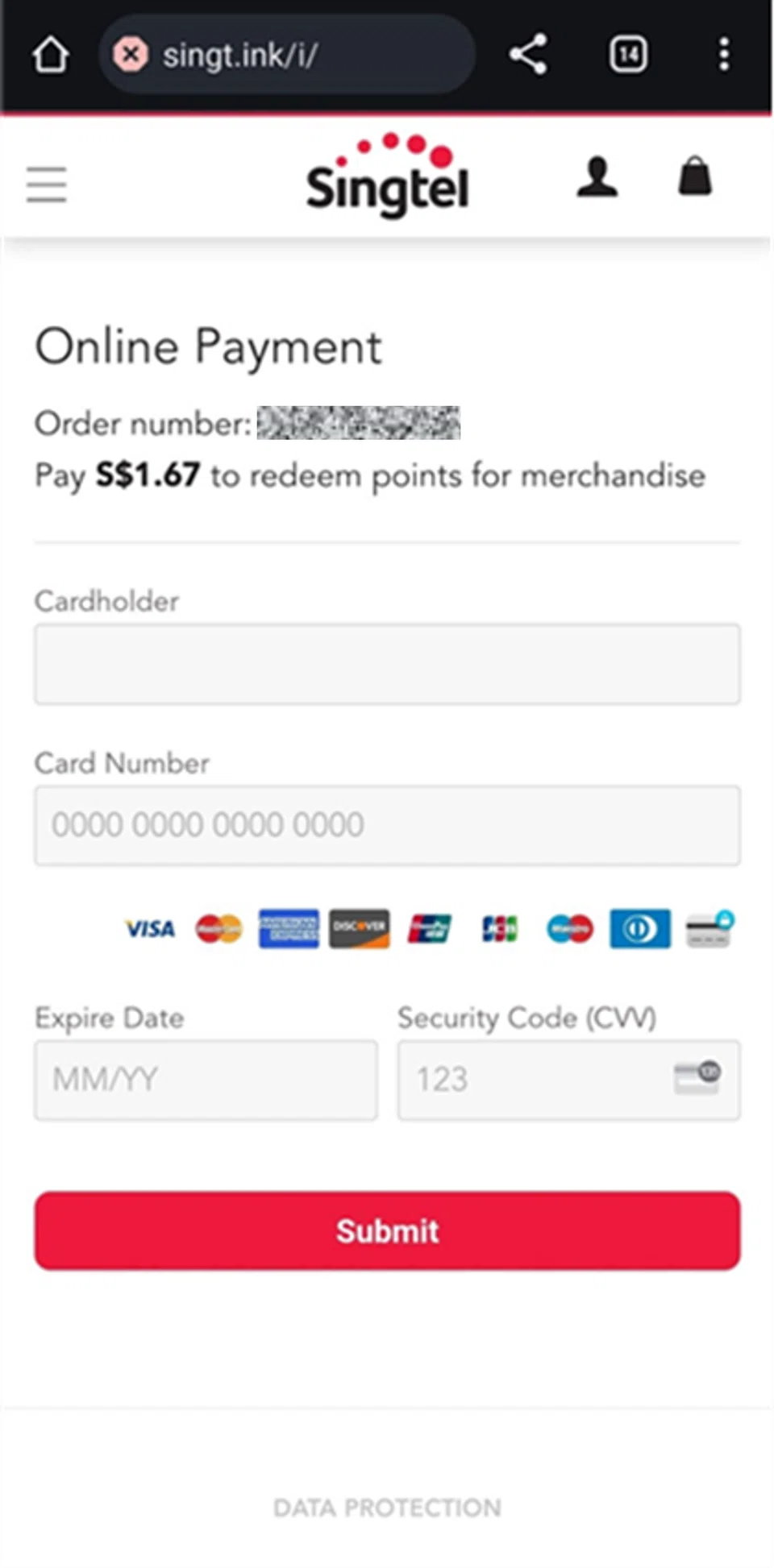

Upon clicking on the link, the victims were directed to a phishing website resembling the actual Singtel redemption web page where they were asked to select their gifts.

The victims were then directed to a payment page and asked to input their credit or debit card details and one-time password (OTP).

They would only realise that they had been scammed when they received notifications from their banks of unauthorised transactions.

Singtel also posted an advisory about the scam SMS on its social media on Sept 6.

The telco advised:

- Delete the SMS immediately.

- If in doubt, call us at 1688 to verify. If you have responded to the message, please contact your bank immediately for assistance.

- Lastly, stay vigilant and never click on malicious links or give out your banking details.

The police advise adopting the following precautionary measures:

- ADD - Reach out to your telcos and their respective sub-brands to activate the international call and SMS blocking features 1 to safeguard yourself against scams. Add and use only official banking apps downloaded from official app stores to make transfers or payments. Add ScamShield app and set security features such as Two-Factor Authentication (2FA) for banking apps, social media and Singpass accounts. Set transaction limits on internet banking transactions, including PayNow and PayLah.

- CHECK - Check for scam signs with official sources (call the Anti-Scam Helpline on 1800-722-6688 or visit www.scamalert.sg), or with someone you trust. Always verify the authenticity of unsolicited clickable links you receive and check the webpage addresses for discrepancies. Never disclose your personal information, internet banking and social media account details, and OTPs to anyone. Be cautious of attractive deals that seem too good to be true. If in doubt, always verify the authenticity of information provided with the company directly.

- TELL - Warn your friends and family about your scam encounter. Call your bank immediately and make a police report if you think you have fallen victim.